Highlights

- Forecasting future cash flow is critical to any company for assessing both future risk of failure and current company value. This forecasting process starts with revenue.

- For more mature companies, the optimal process for forecasting revenue starts with the most recent actual revenue, and adjusts for external forces and internal growth or changes.

- Early-stage and fast-growing companies tend to rely more on either a Top-Down approach or Bottom-Up approach.

- The Top-Down approach focuses on market and product demand. For motivated companies, it is an easier technique that is driven by assumptions on these critical external variables.

- The Bottom-Up approach concentrates on a company's more manageable internal variables. This process takes longer and the result is operation-driven, offering a more calculated and granular result.

- Generally, between the two approaches, the Bottom-Up is preferable to the Top-Down approach for its operational focus, real-time data utilization, and risk management capabilities.

- For earlier-stage companies with less of a track record, the optimal real-world revenue forecast takes the Bottom-Up result and applies it against close competitors, to the market and across scenarios to test its validity against assumed demand.

- In 2025, AI integration enhances both approaches, improving accuracy by 25% or more through predictive analytics and real-time data processing.

Introduction

Forecasting future cash flow is a requirement for any business. At its core, future cash flow directly represents both the future risk of failure and the current value of the company. The initial and most important step in forecasting future cash flows is forecasting revenue.

For companies that are more mature with less disruption, revenue can be forecast using a spectrum of possible formulas. These companies usually begin with a “Left-to-Right” approach as a basis, taking actual revenue from previous years to ground the forecast, then applying changes in variables to adjust on a weighted basis.

However, for companies that are in a growth-phase, previous revenue are less telling or even non-existent, leaving the forecast more difficult. Further, the importance for growing companies in building a forecast that can survive the scrutiny of potential investors makes the process of even greater importance.

Companies with less of a track record tend to rely heavily on either a Top-Down approach or a Bottom-Up approach to forecasting revenue.

As we move into 2025, these methods are being augmented by AI-driven tools that enhance predictive analytics, allowing for more accurate revenue projections and scenario planning. Startups using AI in forecasting report up to 25% improved accuracy, helping them better manage cash flow and attract funding.

The Top-Down Approach

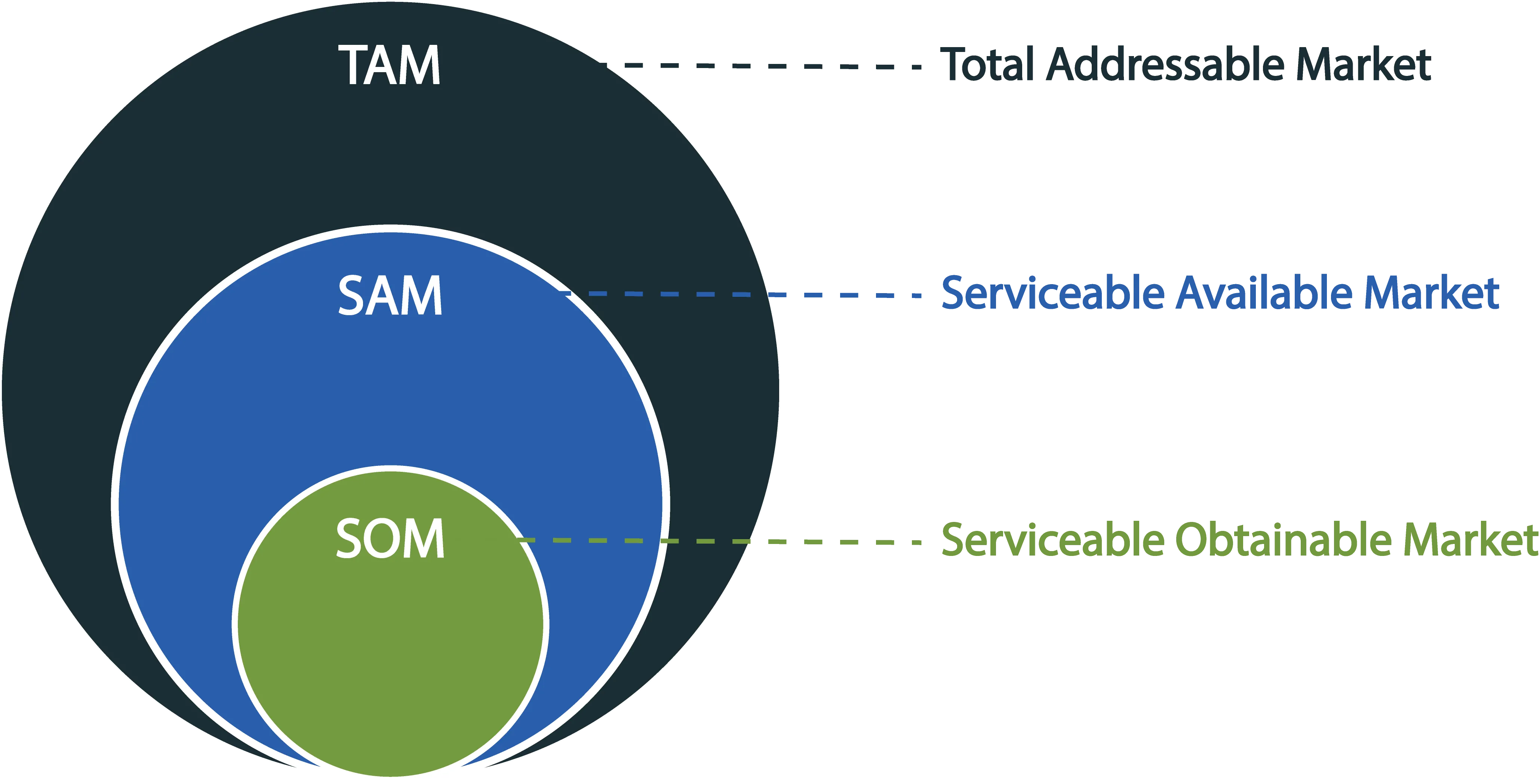

The above image represents a pure Top-Down approach for forecasting revenue. For VC investors, the above image has been seen many times in investor presentations. It is part of the very important (but usually misused) "TAM SAM SOM" slide.

The Top-Down approach is a demand-focussed forecasting method. In its purest form, it starts with the largest measure of the overall market involved, adjusted for any market growth rates, to provide the Total Addressable Market (TAM).

From this, the market size gets adjusted downward to the company's Serviceable Available Market (SAM). This adjustment is based on the company's target segment or niche (the area of the market that is directly targeted by the company’s product).

A final adjustment then carves out a portion of the "SAM", which represents the part of the market the company is expecting to capture (Serviceable Obtainable Market or SOM).

On the positive side, this Top-Down approach does provide a target for a company’s overall market size and focusses some awareness on the company's competition over the long-term. It also is a quick calculation that relies more on the inference of product market existance and size and less on the details of expected operational performance.

For a mature company, these assumptions are backed by previous years' numbers. Here, the use of prior actual revenue numbers bring a deeper proof of market fit and size of the target market, the potential of products or services of the business, and an understanding of the business drivers.

For fledgling companies however, especially companies that have a unique or potentially disruptive product, this simple Top-Down calculation adopts all of the critical assumptions - the existence of a market, the fit of the product in the market appropriate and the assumption of capturing a portion of that market - as given.

For a company looking to generate investor interest, ignoring the importance of fully addressing these assumptions can lead to a poor understanding of the product market and too much focus on external variables, leaving potential investors unconvinced.

In 2025, AI can refine Top-Down forecasts by incorporating dynamic market data and predictive modeling, though it still risks over-optimism if not paired with operational insights.

The Bottom-Up Approach

The Bottom-Up approach is a more supply and company-focussed forecasting style that is built on a number of key operations-based calculations and objectives.

Using a pure, supply-based form, the Bottom-Up method starts with a measure of "inventory", with the additions of the total possible production based on the company's production constraints (cash, labour, supply-chain, supplier or manufacturing limitations). This provides the first pool of size (or limitation) for revenue forecasts.

From this possible production pool, rates from the sales funnel are then applied to the “inventory” (along with unit price points) to provide the amount of revenue for the period. Here, the demand for the product is baked into sales abilities of the company, a more internal metric capturing demand.

This overall process focuses more on the available inputs and the abilities of the company. It immediately focuses on the company, its skills and management, providing objectives for KPIs along the way to the revenue number.

With 2025 trends, Bottom-Up forecasting benefits from AI automation tools like Float or QuickBooks, which integrate real-time data for more precise projections.

Simple Example Comparison

Let's look at a simplified set of examples for both examples using a manufacturing company.

Top-Down Approach

Let's assume the global market for widgets is $1 billion (TAM). Assume you sell only copper widgets, which is a market worth $10 million (SAM). Your company, based on assumptions, expects to gain 10% of your direct market, for $1 million in annual revenue (SOM).

This is your revenue forecast, based primarily on the external forces of the market to underpin your forecast.

Bottom-Up Approach

Again, in a simplistic form, a Bottom-Up approach starts with inventory levels and the amount of cash available (and other inputs) to manufacture more, then adjusts for the forecast rate of manufacturing itself, to arrive at the total inventory possible. Let's assume that you undertake an assessment of your company's capabilities and inventory levels to arrive at a market value of $250,000 in existing inventory and $1 million in likely production - based on fully planned operations and objectives.

We then look at the sales abilities for the company to feed market demand. With what would be based on comparisons and any track-record, if the sales team had an objective of 80% of annual-available-inventory-to-sales, this provides a total annual forecast revenue of $1 million.

Even though both arrive at the same number, the Bottom-Up approach provides a more company-focussed and grounded forecast. The optimal next step here would be to compare the Bottom-Up forecast to a Top-Down expectation, to validate the Bottom-Up forecast.

Scenario planning, a key 2025 practice, can further test these examples under best, worst, and base cases for robustness.

Need to Get a Better Understanding of Your Financial Potential?...

We Can Help

Cash Flow Management

Valuation

Grant Funding

Contact Us to Bring Our Expertise to Your Company

Talk to UsThe Benefits of a Bottom-Up Approach

When comparing the benefits of a Bottom-Up approach versus a Top-Down approach, the keys are the benefits to the company from the Bottom-Up forecast exercise itself, the objectives set for KPIs that result from it, and the favourability of the approach to investors.

-

Reflects Actual Operations and Capacity

Because it begins with the company's actual resources and capacities (such as production limits, sales team size, etc.), the Bottom-Up approach aligns more closely with what the company can realistically achieve in the given timeframe.

-

Empowers Operational Decision-Making

By focusing on the granular aspects of the business, Bottom-Up forecasting provides insights that are crucial for operational decision-making and short-term tactical adjustments.

-

Responsive to Internal Changes

Bottom-Up forecasting is more sensitive to internal changes within a company, such as shifts in sales strategies, operational improvements, or product developments. These factors significantly impact revenue and are better captured in a Bottom-Up model.

-

Real-Time Data Utilization

The Bottom-Up method often uses more current and direct data sources, such as recent sales trends and customer feedback, which can lead to more informed and timely predictions. In 2025, AI tools enhance this by processing real-time data for 20-30% productivity gains.

-

Risk Identification and Management

The detailed nature of the Bottom-Up approach helps in identifying potential risks and challenges at a more granular level, enabling better risk management. AI agents further automate risk assessment in workflows.

-

Useful Across All Business Sizes

Unlike the Top-Down method, which requires a broad market perspective and could be argued only somewhat suitable for larger, established markets, the Bottom-Up approach is effective for businesses of all sizes.

-

Enhanced Investor Credibility

Investors often view Bottom-Up forecasts as more credible because they are based on concrete, operational data and realistic assumptions about sales and market penetration. Startups using predictive analytics are 20% more likely to secure funding.

-

Strategic Planning and Goal Setting

By understanding the limitations and capabilities at a more detailed level using Bottom-Up, companies can set more realistic and achievable goals, leading to better strategic planning.

2025 Updates: AI in Revenue Forecasting

As of 2025, AI is transforming revenue forecasting for startups by integrating into both Top-Down and Bottom-Up methods. AI-driven predictive analytics can improve accuracy by over 25%, enabling better cash flow management and scenario planning.

Conclusion - The Optimal Approach

The benefits of a Top-Down approach are related to its market focus, positive market assumptions and ease of calculation. However, its broad assumptions leave many unanswered questions and assumes the company more susceptable to unmanageable market forces.

In contrast to the Top-Down approach, the Bottom-Up method offers a more granular and arguably more realistic view for revenue. It focusses on what the company can do rather than assumed market demand.

The optimal forecasting process for rapidly growing companies is to start with the Bottom-Up Approach, but then place the results in the Top-Down scenario to understand the viability of the forecast. Not only does this provide a measured forecast based on both supply and demand, but provides the basis for a discussion when outlining the investment thesis to potential investors.

Many entrepreneurs rely on a TAM SAM SOM slide to show evidence of market and revenue potential, with little discussion on what went into the measurement of the "SOM". In reality, this is a missed opportunity.

The discussion on SOM, and the use of a Bottom-Up approach to reach the conclusion, with the support of a "Top-Down" analysis marries supply and demand together for the company.

Getting somewhat granular on strengths and capabilities of the company, while discussing the opportunities and competition in the market is a great approach for mid-process and later meetings with prospective investors.

And given the tighter Venture Capital markets, easy discussions on market availability, market penetration, revenue and capabilities are gone.

In 2025, incorporating AI into this hybrid approach further boosts credibility, with predictive tools aiding in scenario analysis and making forecasts more resilient to economic shifts.

Want to Learn More About Managing Your Company's Finances?

Sign up to receive more information about managing cash flow, increasing your valuation, and raising capital, via email.